200 Malaysian Ringgits to Georgian Laris (MYR to GEL)

| MYR/GEL | Sell GEL | Buy GEL | % |

|---|---|---|---|

| 200 MYR to GEL | 124.11 | 125.51 | -0.1% |

| 1 MYR to GEL | 0.6205 | 0.6275 | -0.1% |

What is 200 Malaysian Ringgit to Georgian Lari?

It is a currency conversion expression that how much 200 Malaysian Ringgits in Georgian Laris is, also, it is known as 200 MYR to GEL in exchange markets.How much is 200 Malaysian Ringgits in Georgian Laris?

200 Malaysian Ringgits equals to 125.50 GELIs 200 Malaysian Ringgit stronger than Georgian Lari?

The exchange rate between Malaysian Ringgit to Georgian Lari is 0.6275. Exchange conversion is less than 1, so, Malaysian Ringgit is NOT stronger than Georgian Lari. Georgian Lari is stronger than Malaysian Ringgit..How do you write currency 200 MYR and GEL?

MYR is the abbreviation of Malaysian Ringgit and GEL is the abbreviation of Georgian Lari. We can write the exchange expression as 200 Malaysian Ringgits in Georgian Laris.How much do you sell Georgian Laris when you want to buy 200 Malaysian Ringgits?.

When you want to buy Malaysian Ringgit and sell Georgian Laris, you have to look at the MYR/GEL currency pair to learn rates of buy and sell. Exchangeconversions.com provides the most recent values of the exchange rates. Currency rates are updated each second when one or two of the currency are major ones. It is free and available for everone to track live-exchange rate values at exchangeconversions.com. The other currency pair results are updated per minute.

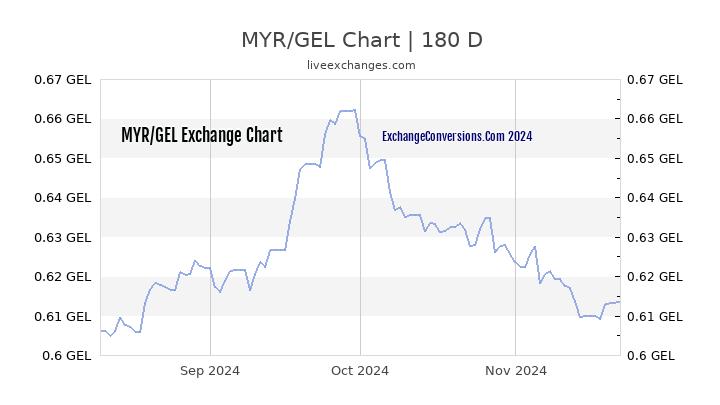

At chart page of the currency pair, there are historical charts for the MYR/GEL, available for up to 20-years.

Exchange pair calculator for MYR/GEL are also available, that calculates both bid and ask rates for the mid-market values. Buy/Sell rates might have difference with your trade platform according to offered spread in your account.

Exchange pair calculator for MYR/GEL are also available, that calculates both bid and ask rates for the mid-market values. Buy/Sell rates might have difference with your trade platform according to offered spread in your account.

MYR/GEL Chart